A bank is one of the major Financial Intermediaries –

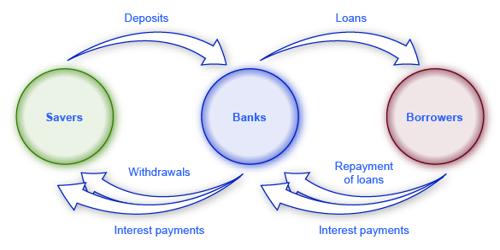

A financial intermediary is a financial institution that connects surplus and deficit agents. The classic, example of a financial intermediary is a bank that consolidates deposits and uses the funds to transform them into loans. A bank is one kind of financial institution which deals with money and other monetary instruments and conducts business. Bank receives deposits from one group of people and lends it to other groups of people. By this process, the bank earns a profit.

Financial Intermediary is a financial institution such as a bank, building a society, insurance company, investment bank or pension fund. Through the process of financial intermediation, certain assets or liabilities are transformed into different assets or liabilities. As such, financial intermediaries channel funds from people who have extra money or surplus savings (savers) to those who do not have enough money to carry out a desired activity (borrowers). It offers a service to help an individual/ firm to save or borrow money. A financial intermediary helps to facilitate the different needs of lenders and borrowers.

A financial intermediary is typically an institution that facilitates the channeling of funds between lenders and borrowers indirectly. That is, savers (lenders) give funds to an intermediary institution (such as a hank), and that institution- gives those funds to spenders (borrowers). This may be in the form of loans or mortgages. Alternatively, they may lend the money directly via the financial markets, which is known as financial and intermediation.