ATM Operation

“Automated Teller Machine – ATM” is an electronic banking outlet, which allows customers to complete basic transactions without the aid of a branch representative or teller. There are two primary types of automated teller machines or ATMs. An ATM is simply a data terminal with two input and four output devices. There are two types of automated teller machine (ATMs). The basic one allows the customer to only draw cash and receive a report of the account balance. Another one is a more complex machine which accepts the deposit, provides credit card payment facilities and reports account information.

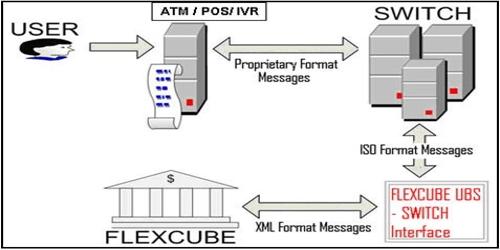

It is an electronic device which is used by only bank customers to procedure account transactions. The users access their account through a particular type of plastic card that is encoded with user information on a magnetic strip. The strip contains a recognition code that is transmitted to the bank’s central computer by modem. The users insert the card into ATMs to access the account and process their account transactions.

ATM machines hold a lot of cash and let’s be real – it’s easier to rob some poor business owner than it is to rob a bank. This is why you should always practice vigilant ATM safety.