A serial bond is a US municipal debt instrument. It is a series of bonds that are issued together, each with a different maturity. An example is the issue of US$100 million on a particular day for each of the periods 5 years, 10 years, 15 years and 20 years. They are all plain vanilla bonds and investors select which series are suitable for them, depending on their investment horizon. Pension funds usually prefer the longer bonds, short-term insurers the medium term bonds, while banks are more interested in the shorter bonds.

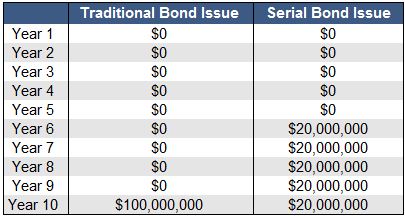

Example: the issuer regarding US $10 in traditional bonds having ten-year maturities will make a US$100 principal payment at the conclusion of the 10th year. But the company of US$100 in serial bonds might structure the offering in ways that US$20 million grows after five a long time, another US$20 million matures the entire year after, $20 million the entire year after that.