Preparation of cash budget Methods

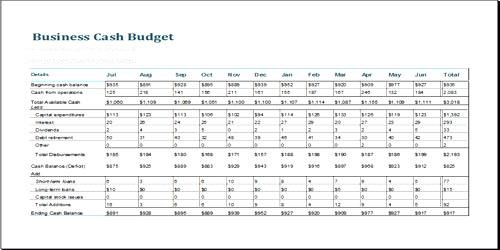

A cash budget is one of the most important budgets prepared by a business concern as every transaction directly or indirectly deals with cash. It shows the estimate of cash receipts and cash payments from all sources over a specific period. A cash budget is an estimation of the cash inflows and outflows for a business over a specific period of time, and this budget is used to assess whether the entity has sufficient cash to operate.

There are three methods by which a cash budget is prepared. They are:

- Receipts and Payments Method.

- Adjusted Profit and Loss Account Method or Cash Flow Method.

- Balance Sheet Method.

However, among the three methods only “Receipts and Payments Method” alone is discussed here.

Receipts and Payments Method

Under this method, Cash budget projects the concern’s cash receipts and payments for a certain period (budget period). It has two basic components:

- Estimate of cash receipts and

- Estimate of cash payments

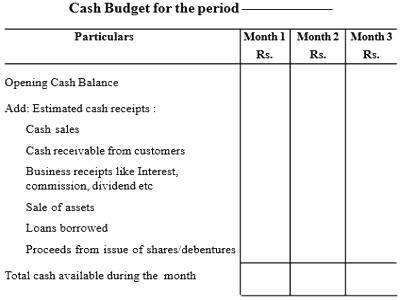

Cash Receipts include:

- Cash sales

- Cash receivable from customers

- Business receipts like interest, commission, dividend etc

- Sale of assets

- Proceeds from issue of shares/debentures

- Loans borrowed

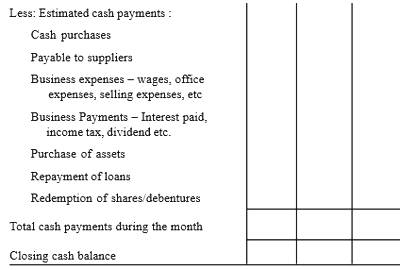

Cash Payments include:

- Cash purchases

- Cash payable to suppliers

- Business expenses like wages, office expenses, selling expenses, etc.

- Payment of interest, income tax, dividend etc.

- Purchase of assets

- Redemption of shares/debentures

- Repayment of loans

Steps in the preparation of cash budget

Step 1: Take opening cash balance

Step 2: Add the estimated total cash receipts for the month

Step 3: Calculate the total cash available for the month

Step 4: Less the estimated total cash payments during the month

Step 5: Calculate the closing cash balance

Cash Budget for the period

Format:

The closing cash balance of the current month will be the opening cash balance of the next month.