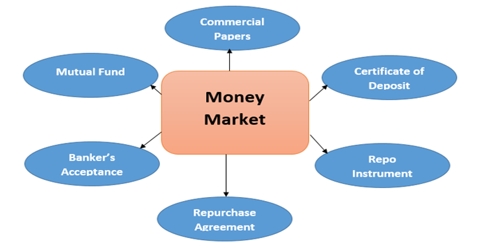

The money market is a market for short-term funds which deals in monetary assets whose period of maturity is up to one year. These assets are secure substitutes for money. It is a market where low risks, unsecured and short-term debt instruments that are highly liquid are issued and actively traded every day. It has no physical location but is an activity conducted over the telephone and through the internet.

One of the major differences between the money market and the stock market is that most money market securities trade in very high denominations. It enables the raising of short-term funds for meeting the temporary shortages of cash and obligations and the provisional deployment of excess funds for earning returns.

Money markets serve five functions—to finance trade, finance industry, invest profitably, enhance commercial banks‘ self-sufficiency, and lubricate central bank policies. The major participants in the market are the Reserve Bank of a State, Commercial Banks, Non-Banking Finance Companies, State Governments, Large Corporate Houses and Mutual Funds.