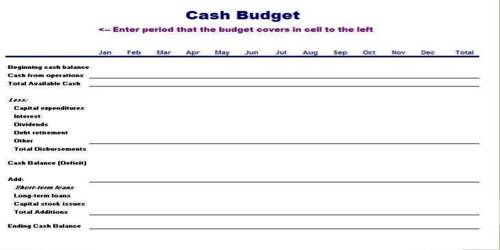

The cash budget is a detailed plan showing how cash resources will be acquired and used over a specific time period. So this budget is divided into two parts, one showing the estimated cash receipts on account of cash sales, credit collections and miscellaneous receipts and the other showing the estimated disbursement on account of cash purchases, account payable to creditors, wages payable to workers, indirect expenses payable, income tax payable, dividend payable etc.

No matter what the nature of your business, it is important to manage your cash flow carefully. Accurately predicting how much money is coming in and how much cash is flowing out can help your business stay on track, and a cash budget is one of the best tools for managing your firm’s money.

Following are the steps in the preparation of Cash Budget:

Step #1: Determine an adequate minimum cash balance. Past operating records should indicate the proper cash cushion needed to cover any unexpected expenses after all normal expenses are deducted from the month’s cash receipts.

Step #2: Forecasting Sales: There are several ways that the book recommends to forecast sales such as; sales patterns, chamber of commerce and trade, and market research. The book also says, no matter what techniques entrepreneurs use to forecast cash flow, they must recognize that even the best sales estimates may be wrong.

Step #3: Forecasting Cash Receipts: When a company sells goods and services on credit, a cash budget must count for the delay between the sale and the actual collection of the proceeds.

Step #4: Forecasting Cash Disbursements: Is when a business has a clear picture of the company’s pattern of cash outflow.

Step #5: Estimating the end of the month cash balance. Entrepreneurs must determine the cash balance at the beginning of each month. The beginning cash balance includes cash on hand as well as cash in savings and checking accounts. The cash balance at the end of the month becomes the beginning balance for the following month.