The return on working capital ratio compares the earnings for a measurement period to the related amount of working capital. This measure gives the user some idea of whether the amount of working capital currently being used is too high, since a minor return implies too large an investment.

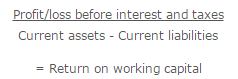

To calculate the return on working capital, divide profit before interest and taxes for the measurement period by working capital.

The formula is:

If the ending working capital figure for the period is unusually high or low, consider using an average figure for the reporting period instead.

This ratio should only be considered a general indicator of working capital performance, for it does not take into consideration a number of additional factors, which include the following:

- Intellectual capital. A business might be able to generate unusually large profits because of key patents, which have nothing to do with the working capital investment.

- Fixed assets. The key driver of profits may be the fixed asset base, such as the equipment used by an oil refinery. This large investment is not included in working capital.

- Customer requirements. In order to do business in certain industries, it may be necessary to offer customers lengthy payment terms and high order fulfillment rates, which require a large investment in working capital.

Despite the objections just noted, it can be useful to track this ratio on a trend line, to see if the return is worsening. If so, an event may have occurred since the last measurement period which can be corrected.