Standard costing offers managers several benefits that can help their business run more efficiently. Though most businesses no longer use standard costing in its original application of calculating the cost of ending inventory, it is still useful for a variety of other purposes. Most users are probably unaware that they are using standard costing, only that it is an approximation of actual costs. Here are some examples of possible applications:

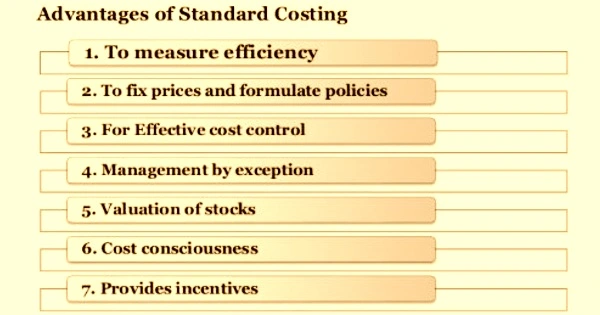

Advantages of Standard Costing –

- Budgeting

A budget is always made up of standard costs because it is impossible to include the exact actual cost of an item on the day the budget is finalized. Furthermore, because a key application of the budget is to compare it to actual results in subsequent periods, the standards used within it continue to appear in financial reports throughout the budget period.

When managers have used the standard costing system to control costs, the actual costs in the future should be close to the standard costs. This is a very positive outcome because it means that the profit plan was followed exactly as planned. This can lead to more accurate budgets in the future.

- Inventory costing

If you use a perpetual inventory system, it is extremely simple to print a report showing the period-end inventory balances, multiply it by the standard cost of each item, and instantly generate an ending inventory valuation. The result does not exactly match the actual inventory cost, but it comes close. However, if actual costs are constantly changing, it may be necessary to update standard costs on a regular basis. It is easiest to update inventory costs on a regular basis for the highest-dollar components, leaving lower-value items for occasional cost reviews.

- Overhead application

If it takes too long to aggregate actual costs into cost pools for inventory allocation, you can instead use a standard overhead application rate, which you can adjust every few months to keep it close to actual costs.

A standard costing system estimates projected costs quickly. Though accurate reports are desirable, they are not delivered on time. A good cost estimate that is provided quickly is highly preferred.

- Price formulation

If a company deals with custom products, it will use standard costs to calculate the projected cost of a customer’s requirements, then add a margin. This could be a complicated system in which the sales department uses a database of component costs that change depending on the unit quantity that the customer wants to order. This system may also account for changes in the company’s production costs at various volume levels, as this may necessitate the use of longer, less expensive production runs.

In the event of variances, managers are allowed to rectify any discrepancies. This will then allow them to improve cost control. This means they can be more aware of spending habits in the future and strive for little to no variances.

- Lower production costs

When implementing a standard cost system, lower production costs may be an advantage. Employees may become more cost-conscious, efficient, and focused on their performance as a result of standard costing, which allows others to visualize their spending habits. This may result in lower overall production costs.

Almost all businesses have budgets, and many use standard cost calculations to determine product prices, so standard costing will continue to be useful in the foreseeable future. Standard costing, in particular, serves as a benchmark against which management can compare actual performance.