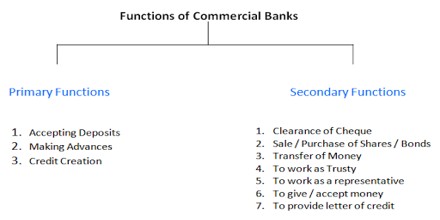

Functions of Commercial Banks

Banks perform a variety of functions. Some of them are the basic or primary functions of a bank while others are the agency or general utility services in nature. The important functions are briefly discussed below:

(i) Acceptance of deposits: Deposits are the basis of the loan operations since banks are both borrowers and lenders of money. As borrowers they pay interest and as lenders, they grant loans and get interest. These deposits are generally taken through the current account, savings account and fixed deposits. Savings accounts are for encouraging savings by individuals.

(ii) Lending of funds: the Second major activity of commercial banks is to provide loans arid advances out of the money received through deposits. These advances can be made in the form of overdrafts, cash credits, discounting trade bills, term loans, consumer credits and other miscellaneous advances. The funds lent out by banks contribute a great deal to trade, industry, and transport arid other business activities.

(iii) Cheque facility: Banks render a very important service to their customers by collecting their cheques drawn on other banks. The cheque is the most developed credit instrument, a unique feature and function of banks for the withdrawal of deposits. It is the most convenient and an inexpensive medium of exchange. There are two types of cheques mainly (a) bearer cheques, which are en-cashable immediately at bank counters and (b) crossed cheques which are to be deposited only in the payees account.

(iv) Remittance of funds: Another salient function of commercial banks is of providing the facility of fund transfer from one place to another, on account of the Interconnectivity of branches. The transfer of funds is administered by using bank drafts, pay orders or mail transfers, on nominal commission charges. The bank issues a draft for the amount on its own branches at other places or other banks at those places. The payee can present the draft, on the drawee bank at his place and collect the amount.

(v) Allied services: In addition to above functions, banks also provide allied services such as bill payments, locker facilities, underwriting services. They also per other services like buying and selling of shares and debentures on instructions and other personal services like payment of insurance premium, a collection of dividend etc.