Trial Balance is a list of closing balances of ledger accounts on a certain date and is the first step towards the preparation of financial statements. It is usually prepared at the end of an accounting period to assist in the drafting of financial statements. Ledger balances are segregated into debit balances and credit balances. Asset and expense accounts appear on the debit side of the trial balance whereas liabilities, capital and income accounts appear on the credit side.

- Trial Balance acts as the first step in the preparation of financial statements. It is a working paper that accountants use as a basis while preparing financial statements.

- Trial balance ensures that for every debit entry recorded, a corresponding credit entry has been recorded in the books in accordance with the double entry concept of accounting. If the totals of the trial balance do not agree, the differences may be investigated and resolved before financial statements are prepared. Rectifying basic accounting errors can be a much lengthy task after the financial statements have been prepared because of the changes that would be required to correct the financial statements.

- Trial balance ensures that the account balances are accurately extracted from accounting ledgers.

- Trail balance assists in the identification and rectification of errors.

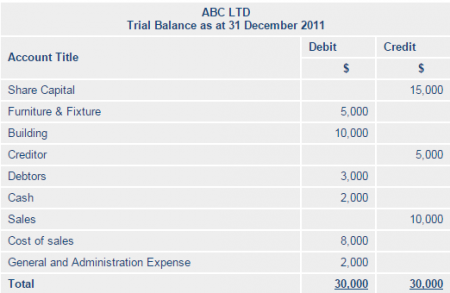

Example:

Following is an example of what a simple Trial Balance looks like:

- Title provided at the top shows the name of the entity and accounting period end for which the trial balance has been prepared.

- Account Title shows the name of the accounting ledgers from which the balances have been extracted.

- Balances relating to assets and expenses are presented in the left column (debit side) whereas those relating to liabilities, income and equity are shown on the right column (credit side).

- The sum of all debit and credit balances are shown at the bottom of their respective columns.

Limitation of Trial balance:

Trial Balance only confirms that the total of all debit balances match the total of all credit balances. Trial balance totals may agree in spite of errors. An example would be an incorrect debit entry being offset by an equal credit entry. Likewise, a trial balance gives no proof that certain transactions have not been recorded at all because in such case, both debit and credit sides of a transaction would be omitted causing the trial balance totals to still agree. Types of accounting errors and their effect on trial balance are more fully discussed in the section on Suspense Accounts.