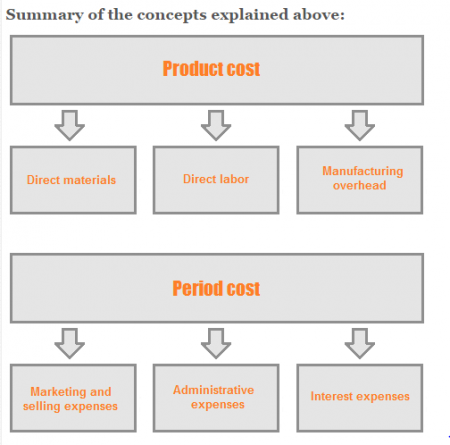

Costs might be classified as product or service costs and period of time costs. This classification is normally used for monetary accounting purposes. A shorter explanation of product or service costs and period of time costs is given below:

Product costs:

Product costs (also called inventoriable costs) are usually those costs which might be incurred to obtain or manufacture a program. For a manufacturing company, theses costs usually incorporate direct materials, immediate labor, and manufacturing overhead.

Product costs are usually initially treated as inventory and do not appear on income statement till the product for which they are incurred comes. When the product comes, these costs are utilized in cost of items sold account. As an example, if a corporation manufactures 50 devices of product By and sells only 30 units inside 2013. The immediate materials, direct labor along with manufacturing overhead fees incurred to make these 50 units is going to be initially treated as inventory (an asset). The inventory regarding 30 units is going to be transferred to charge of goods sold over the year 2013 and search on the profits statement of 2013. The remaining catalog of 20 units will not be transferred to charge of good sold in 2013.

Period costs:

The costs which can be not included within product costs are often known as period costs. Usually, these costs are not section of the manufacturing process and are also therefore treated as expense to the period in they will arise.

Period costs aren’t attached to products and company doesn’t need to wait to the sale of products to understand them as purchase. According to generally accepted accounting ideas (GAAP), all marketing and advertising, selling and management costs are handled as period costs. Examples of these kind of costs include workplace rent, interest, depreciation of office, sales commission along with advertising expenses for example.