Straight line amortization is a method for charging the cost of an intangible asset to expense at a consistent rate over time. This method is most commonly applied to intangible assets since these assets are not usually consumed at an accelerated rate, as can be the case with some tangible assets.

Straight Line Amortization is the repayment of a loan through a fixed number of fixed-amount monthly installments. While the amount of the installment is the same every month, however, it is apportioned unequally between interest and principal payments. In the early years, the major proportion (as much as 90 percent) of the installment amount goes towards the payment of the interest.

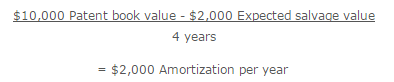

The formula for calculating the periodic charge under straight-line amortization is:

![]()

For example, a business has bought a patent for $10,000 and expects to sell it off to another business in four years for $2,000. The calculation of its straight-line amortization charge is:

Straight line amortization is the same as straight-line depreciation, except that it applies to intangible assets, rather than tangible assets.

The term can also be applied to the repayment of a loan via a series of periodic payments that are in the same amount. Each of these payments includes interest and principal components. Early in the series of payments, the bulk of the payments is comprised of interest charges, with modest principal repayments. As the principal repayments gradually reduce the outstanding amount of the loan, the proportion of interest expense in each successive payment declines, allowing for an increased proportion of each payment to be assigned to the principal.