Overhead is those costs required to run a business, but which cannot be straight attributed to any particular business activity, product, or service. A manufacturing concern incurs different items of costs while converting raw materials into finished outputs. The overheads are the aggregate of all indirect costs such as indirect materials, indirect wages, and other indirect expenses. They are also known as ‘common costs or on costs. They are called common costs because they are common expenses incurred for different products and departments.

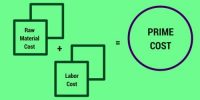

Similarly, they are also known as ‘on cost’ as they are the costs over and above the prime cost or total of all direct costs. Overheads or indirect costs are incurred not just for a particular product unit or cost center, but for a number of cost units or cost centers. Therefore, they cannot be identified with a particular cost center or cost unit. Hence overheads should be appropriately apportioned to a number of cost units or cost centers while determining the total cost of different products.

Classification of Overheads –

Overheads can be classified on a different basis. The common basis of classifying overheads is as follows:

(1) Classification of Overheads Based On Function

- Manufacturing Overheads,

- Non-manufacturing overheads.

(2) Classification of Overheads Based On Behavior

- Fixed Overheads

- Variable Overheads

- Semi-variable Overheads

- Semi-fixed Overhead.

(3) Classification of Overheads Based On Elements

- Indirect Materials

- Indirect labor (Wages)

(4) Classification of Overheads Based On Control

- Controllable Overheads

- Uncontrollable Overheads.