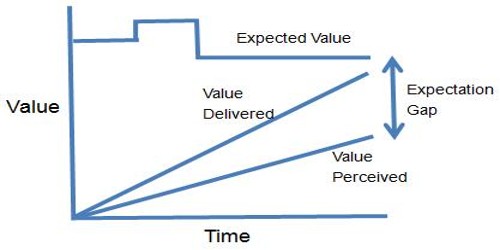

Expectation Gap

The term expectation gap is defined as a gap between the expectation of users of assurance reports, particularly of audit report under the companies act and the firm’s legal responsibilities. It is the gap between an auditor’s actual standard of performance and the more rigorous public expectation of what an auditors performance should be. Many members of the public expect that:

(a) Auditors should accept prime responsibility for the financial statements

(b) Auditors certify financial statements

(c) A clean opinion guarantees the accuracy of financial statements

(d) Auditors perform a 100% check

(e) Auditors should give early warning about the possibility of business failure.

Such public expectations of auditors, which go beyond the actual standard of performance by auditors, have led to the term “expectation gap”. For example, the users of financial statements may expect that an assurance engagement involves the checking of every single transaction while the audit firm checks the transactions on test basis or sample basis.

Finally, the expectation gap is the gap between the auditors ‘actual standard of performance and the various public expectations of auditors’ performance (as opposed to their required standard of performance).