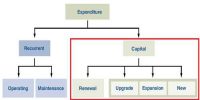

The factors relevant in determining the annual depreciation for a depreciating asset are the initially recorded amount (cost), estimated salvage value, estimated useful life, and depreciation method.

Assets are typically recorded at their acquisition cost, which is in most cases objectively determinable. But cost assignments in other cases “basket purchases” and the selection of an implicit interest rate in asset acquisition under deferred payment plans – may be quite subjective, involving considerable judgment.

The salvage value is an estimate of an amount potentially realizable when the asset is retired from service. The estimate is based on judgment and is affected by the length of the useful life of the asset.

The useful life is also based on judgment. It involves selecting the “unit” of measure of service life and estimating the number of such units embodied in the asset. Such units may be measured in terms of time periods or in terms of activity (for example, years or machine hours). When selecting the life, one should select the lower (shorter) of the physical life or the economic life. Physical life involves wear and tear and casualties; economic life involves such things as technological obsolescence and inadequacy.

Selecting the depreciation method is generally a judgment decision, but a method may be interested in the definition adopted for the units of service life, as discussed earlier. For example, if such units are machine hours. the method is a function of the number of machine hours used during each period. A method should be selected that will best measure the portion of services expiring each period. Once a method is selected, it may be objectively applied by using a predetermined objectively derived formula.