Earnings per share (EPS) ratio measures the amount of dollars of net income have been gained by each write about of common stock. It is computed by dividing net income less preferred dividend by the number of shares of frequent stock outstanding throughout the period. It might be a popular measure regarding overall profitability on the company and is generally expressed in money.

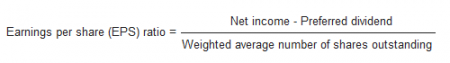

Formula

Earnings per share ratio (EPS ratio) is computed by the following formula:

The numerator is the net income for common stockholders (net income less preferred dividend) and also the denominator is the usual number of stocks of common stock outstanding in a period.

The formula of Earnings Per Share ratio is similar to the formula of return on stockholders equity percentage except the denominator of EPS ratio formula is how much average shares of common stock outstanding rather than the average common stockholders fairness.

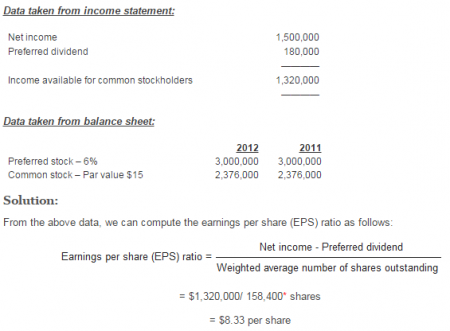

Example:

Following data has been extracted from the financial statements of Peter Electronics Limited. You are required to compute the earnings per share ratio of the company for the year 2012.

Average number of shares outstanding during 2012:

[($2,376,000/$15) + ($2,376,000/$15)] /2

= [158,400 + 158,400] /2

= 158,400

The EPS ratio is $8.33. It means every share of the common stock earns 8.33 dollars of net income.

Significance and Interpretation:

The shares are usually purchased to acquire dividend or sell them in a higher price inside future. EPS figure is vital for actual and potential common stockholders considering that the payment of dividend and increase from the value of investment in future largely will depend on the earnings on the company. EPS would be the most widely quoted and relied physique by investors. In most of the countries, the local companies are needed to report EPS figure on the income statement.