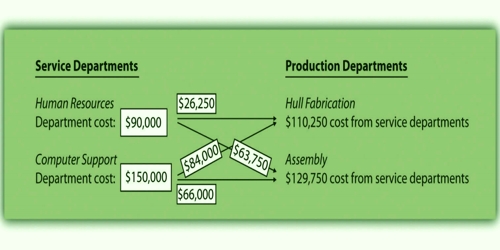

The costs of service departments are allocated to the operating departments because they exist to support the operating departments. The sequence of allocation usually starts with the service department that has incurred the greatest costs. Service department costs are allocated to operating units via an allocation procedure. Service departments present services to each other and at a similar time to the production department.

Methods that used for allocating service department costs to producing departments –

(a) The Direct Method: The direct method is the most, widely-used method. This method allocates each service department’s total costs directly to the production, departments, and ignores the fact that service departments may also provide services to other service departments. The direct method allocates costs of each of the service departments to each operating department based on each department’s share of the allocation base.

(b) The Step-Down Method: The step-down method is also, called the sequential method. This method allocates the costs of some service departments to other service departments, but once a service department’s costs have been allocated, no subsequent costs are allocated back to it. This method allocates service costs to the operating departments and other service departments in a sequential process.

(c) The Reciprocal Method: The reciprocal method is the most accurate of the three methods for allocating service department costs because it recognizes reciprocal services among service departments. Under the reciprocal cost, the relationship between service departments is recognized and the cost is allocated to and from each service department for services provided. It is also the most complicated method; because it requires solving a set of simultaneous linear equations.