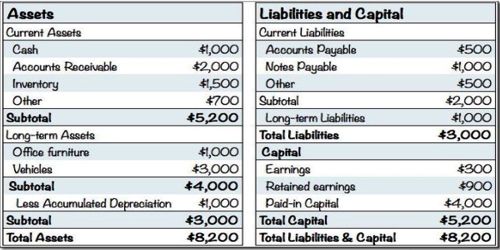

Items included in the Liabilities Side of the Balance sheet

Fixed Liabilities

Those liabilities which are payable to the owners only on the liquidation of the company after making the payment of other outside liabilities are called fixed liabilities. Fixed liabilities are those long term liabilities, which a company has to pay after a time period of at least one year. It simply means that these liabilities become due for a business enterprise, after one year. Example: Debenture, Bonds, Mortgages etc.

Current liabilities are those types of liabilities which are payable out of current assets within the next accounting period. Bills payable short term bank overdrafts are examples of current liabilities. A current liability is an obligation that is payable within one year. The cluster of liabilities comprising current liabilities is closely watched, for business must have sufficient liquidity to ensure that they can be paid off when due.

Long term Liabilities

Long term liabilities are those liabilities which are not payable within the next accounting period but will be payable within next few years. Debentures are the example of long term liabilities. That is, a long-term liability is an obligation that is not due within one year of the date of the balance sheet. Some examples of long-term liabilities are the noncurrent portions of the following: bonds payable, long-term loans, capital leases etc.