Pngme CEO Brendan Playford’s hybrid credit system and decentralized credit bureau, Masa Finance, has secured $3.5 million in pre-seed investment. The startup intends to use blockchain technology to “disrupt existing centralized credit infrastructure by offering consumers, organizations, and developers with the means to access credit,” according to a statement. The ownership of assets, like as money and financial data, is central to the blockchain premise. Traditional financial institutions like as banks and credit bureaus, which have gathered and kept financial information on the world banked people for decades, are under some pressure from the system.

The notion of decentralized finance extends beyond this group of banked persons. Analysts claim that the technology can reach areas where major financial institutions do not operate. According to them, blockchain can help the unbanked gain access to services such as lending, borrowing, and purchasing insurance more quickly. Even because Masa Finance focuses on marginalized individuals, there is still possibility for collaboration between the two industries.

Masa Finance connects users’ crypto holdings to regular financial accounts and assets from credit bureau systems and bank data. Users may access credit and other financial tools over this link, which allows the corporation to construct non-fungible credit reports for them. On a teleconference with TechCrunch, creator Playford said, “The vision that I’ve had for a very long time has been how credit bureaus change and what do would they look like in the future.” “The Masa protocol’s future is to be totally decentralized, with governance and administration handled by a DAO structure.”

Playford spent over a decade working in the blockchain and crypto industry before founding Pngme, an open finance firm that has garnered over $18 million in venture capital investment. He claimed in February that his engagement led him to offer short-term crypto loans to businesses, mostly in Kenya and Tanzania, as well as traditional loans through Pngme, before turning to an open finance strategy. Masa Finance was formed as a result of these joint ventures. According to Playford, the firm is founded on three pillars: financial data unlocking (which Pngme accomplishes), new sources of finance, and allowing consumers to control and share their credit history with any lender.

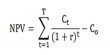

Masa’s web3 infrastructure integrates over 10,000 off-chain data sources including credit bureaus, bank data aggregators, and other data sources from 78 countries to provide on-chain credit scoring for its consumers. Masa claims that by combining off-chain and on-chain data into a non-fungible credit report, it provides lenders and developers with the tools they need to assess borrower risk and create loan solutions for individuals and enterprises throughout the world.

“The future we’re creating is one in which people control their own data.” This will link an off-chain world with centralized data to a new on-chain world that will expand over the next 10 to 20 years,” Playford, who co-founded Masa with chief of staff Dusty Swartz, explained. “As a result, you may combine multiple data sources to construct a decentralized credit profile on Masa and retain control over your decentralized credit profile.” Masa claims that its on-chain data encompasses 26 integrations, ranging from exchanges to wallets, allowing it to get into a 4.95 billion-person market, of whom 67 percent are credit-invisible. Binance, Coinbase, FTX, Gemini, and Metamask are among these wallets.

“They’re cooperating with credit bureaus because it expands coverage for the largest amount of consumers.” By offering credit bureau records, we want to draw the next billion individuals to DeFi. When asked why Masa selected a hybrid architecture rather a fully decentralized model, Playford responded, “You have to maintain existing infrastructure and work with people presently in the market.” Masa is built on Celo and Ethereum, according to Playford, and 36,000 individuals have already joined up for the site, which is now out of beta.

The majority of its current users are from Sub-Saharan Africa, particularly Nigeria and Kenya. Users from these countries, which include Uganda and the Philippines, are responsible for the biggest amount of loans in Goldfinch, a lending protocol Masa Finance intends to join with shortly after raising $25 million in January from a16z and Coinbase Ventures.