Selection of borrower is the most important factor of sound lending –

Lending is one of the most important functions of commercial banks. The major portion of the income of a commercial bank generates through lending. By lending, banks take a huge risk of default on repayment. The risk starts from the first step of lending which is ‘borrower selection’. Though a loan may default for various reasons, every credit officers of a commercial bank should give their concentration profoundly when they primarily select a borrower for lending. Because a wrong selection may hamper the profitability of banks.

The major portion of the bank’s funds is employed by way of loans and advances, which is the most profitable employment of its funds. Thus lending is a crucial activity for a bank enabling it to generate income.

These decisions generally relate to the size, security, and repayment of credit to be extended during a financial year, the industries to focus on, the geographical spread, type of credit to offer, type of proposals to finance, disbursal mechanism, collateral value, pricing method, repayment schedule, monitoring process etc.

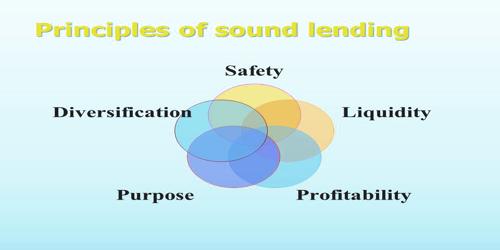

We know Credit Investigation is the assessment of loan proposal from different angles to judge or justify for approval. Borrower selection is the basic and most essential part of credit investigation. Every prudent banker investigates loan proposals to confirm Safety, Liquidity, and Profitability of their concern. Among safety; liquidity and profitability, one should not be sacrificed for another.

Commercial Bank will carefully analyze and consider common 7 factors before sanctioning loans to its customers.

- Liquidity.

- Profitability.

- Safety and Security.

- Purpose.

- Sources of Repayment.

- Diversification of Risk.

- Social Responsibility.

Now the million dollar question is how to select a borrower before allowing any credit facility who would not be a defaulter. Though it is near to impossible to declare that a specific borrower will never default because there are lots of grounds exist to default a loan, but banker can curtail the risk by selecting a good borrower.