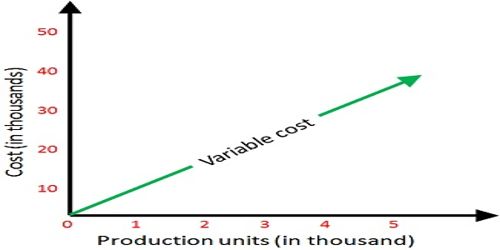

Usages of variable / direct costing in decision making: Under variable costing, only those manufacturing costs that very without put are treated as product costs. This includes direct materials, variable overhead, and ordinarily direct labor. Fixed manufacturing overhead is treated as a period cost and it is recorded on the income statement as incurred, by contrast, direct labor, and variable overhead. Practically speaking, variable costing can’t be used externally for either financial or tax reporting. Variable Costing is a managerial accounting cost concept. Under this method, manufacturing overhead is incurred in the period that a product is produced. However, it may be used internally by managers for planning and control purpose. The variable costing approach costing approach works well with CVP analysis. It provides managers with the information necessary to prepare a contribution margin income statement, which leads to more effective cost-volume-profit (CVP) analysis. By separating variable and fixed costs, managers are able to determine contribution margin ratios, break-even points, and target profit points, and to perform sensitivity analysis.

A common example of a variable cost is the direct materials cost. It enables a company to run the cost-volume-profit investigation, which is intended to expose the company’s break-even point in production by formative how many products a company must produce and sell to reach the point of profitability.