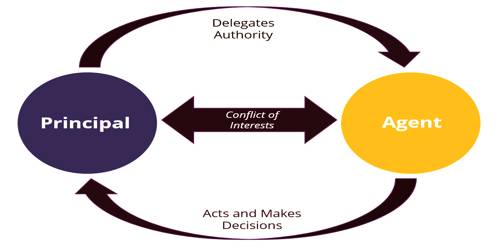

Agency Problem: Conflicts of interest among stockholders, bondholders, and managers is called agency problem. It is assumed that the managers and the shareholder if left alone, will each attempt to act in his or her own self- interest. Which creates the conflicts of interest can be termed as agency conflicts. The agency problem does not exist without a relationship between a principal and an agent.

Two major agency conflicts that arc exist in corporate finance:

Manager VS Owners:

In the case of Joint Stock Company, ownership is separated from management. For this reason, owners directly cannot take part in management. The responsibility of management is on the hand of the professional manager. Sometimes professional managers, give priority of their own interest without consideration to stockholder’s interest. As a result, conflicts of interest between managers and owners are created.

Creditors VS Owners:

Creditors want to have principal’ and interest payment form owners timely. But owners are not willing to pay the claim of the creditors from their personal income if a sufficient amount of profit is not earned by the company. As a result, conflict arises. Sometimes managers on behalf of shareholders hurt the interest of bondholders by investing in a highly risky project which is financed by debt capital.