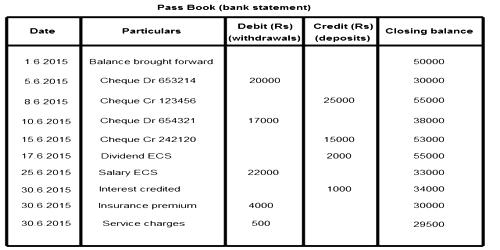

The amount credited by the banker in the pass book without the immediate knowledge of the customer

The following are several of the examples for the above statement

- The bank might have collected rent, dividend, bills of exchange, interest etc., due for the customer as per standing instructions.

- Some debtors might have straight paid into the bank.

- Bank credits interest on the credit balance of the customer’s account.

- The banker has incorrectly credited this account instead of some other account.

In all the above cases, the entry will be first entered in the pass book. The client will know this only after he verifies the entries in the pass book. So there may be a time gap of some days before the client includes entries made in the pass book.

For example, the bank has credited ABC Company Limited’s account for interest amounting to $ 1000 on May 31, 2000. The bank prepares and sends a statement of account on May 31, 2000. If the client receives the statement of account on June 5, 2000, there will be a dissimilarity of $ 1000 between the balance shown by the cash book and the balance shown by the pass book.