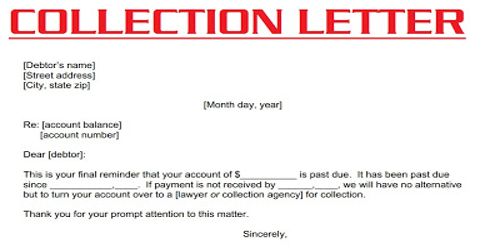

Features of Collection / Dunning Letter

Collection or dunning letters possess some distinct features that differentiate them from other business letters. An effective collection letter should not only notify the consumer of the late payment but also maintain good customer-business relations. Some of the features of collection letter are as follows:

Parties involved: The creditor should keep patience while communicating through such letter. The buyer who buys on credit and seller are involved in collection letter. Seller writes this letter to the buyer for payment of dues. Lack of patience may result in loss of money, goods and the customer’s future business.

Series of letters: Collection letters are written in a series. The series includes reminder letter, inquiry letter, appeal and urgency letter, sawing letter.

Objective: The prime objective of wringing collection letter is to realize the dues from the customers.

Governing principle: The governing principle of this letter is to collect the dues by retaining the customers with the company.

Referring the previous letter: When dunning letters are written in a series, every subsequent letter mentions the reference of the immediate earlier letter.

The threat for legal action: The last letter of collection letter series warns the customer that the matter has been handed over to the lawyers for taking necessary legal action.

Sent through registered post: The seller sends collection letter especially, the last letter of the series through registered with acknowledgement to avoid unnecessary delay or missing of the letter or denial from the pan of the customer.

Language: the language of such letter must be tact and persuasive so that collection of debt, as well as goodwill, remain side by side. This letter is written by using friendly, persuasive, but straightforward language.