A managed float exchange rate system is an international financial arrangement, whereby central banks intervene only periodically, not necessarily to support a country’s currency, but rather to stabilize volatile fluctuations in foreign exchange rates. Managed Float is a floating exchange rate in which a government intervenes at some frequency to change the direction of the float by buying or selling currencies.

A managed float is sometimes called a “dirty float” because exchange rates are free to fluctuate, but central banks are committed to intervening under conditions of perceived instability. The central bank steps in to offset only so much of a change in demand or supply to bring the exchange rate back into an acceptable “band” or range of exchange rates. The last part explains the advantages and disadvantages of a managed float exchange rate system.

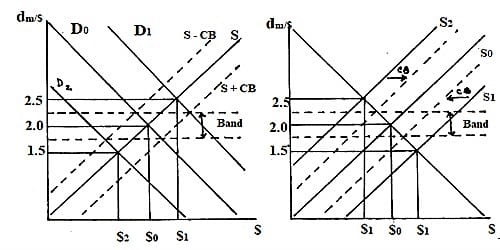

Fig: Managed Floating Exchange Rate System

When demand increases from D0 to D1, the excess demand puts upward pressure on the value of the dollar and the value of the dollar increases from 2.0 dm/$1 to 2.5dm/$. Since 2.5 dm/$ is above the upper bound of the specified band, the central bank steps in and sells the country’s currency to bring the exchange rate back down within the band. When demand decreases from D0 to D2, the excess supply puts downward pressure on the value of the dollar and the value of the dollar decreases from 2.0 dm/$ to 1.5 dm/$. Since 1.5 dm/$ is below the lower bound of the specified band, the central bank steps in and buys the country’s currency to bring it back up within the band.

This policy evolved from the historical inclination of most nations to fix exchange rates, which was then countered with the theoretical benefits of unrestricted flexible exchange rates. But the government and/or central bank of a country may settle on to user involvement in the currency market as a way of manipulating its value to achieve given macroeconomic objectives

For example, an attempt to bring about a depreciation to

- Improve the balance of trade in goods and services / improve the current account position,

- Reduce the risk of a deflationary recession – a lower currency increases export demand and increases the domestic price level by making imports more expensive,

- To rebalance the economy away from domestic consumption towards exports and investment

Overall, one key aim of managed floating currencies is to reduce the volatility of exchange rates. A floating exchange rate is determined in foreign exchange markets depending on demand and supply, and it generally fluctuates constantly. When a financial authority of a country allows the currency to float – that is allowing its exchange rate to move up or down depending on supply and demand in the foreign exchange market – but still intervenes in the market to make sure the exchange rate does not move beyond assumed official limits. This is because big fluctuations in the external value of a currency can increase investor risk and perhaps damage business confidence.