Break even sales is the dollar amount of revenue at which a business earns a profit of zero. This sales amount exactly covers the underlying fixed costs of a business, plus all of the variable costs associated with the sales. It is useful to know the break even sales level, so that management has a baseline for the minimum amount of sales that must be generated in each reporting period to avoid incurring losses. For example, if a business downturn is expected, the break even level can be used to pare back fixed expenses to match the expected future sales level.

To calculate break even sales, divide all fixed expenses by the average contribution margin percentage. Contribution margin is sales minus all variable expenses, expressed as a percentage.

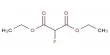

The formula is:

For example, ABC International routinely incurs $100,000 of fixed costs in each month. The company’s contribution margin is 50%. This means that the business reaches a break even sales level at $200,000 of sales per month.

There are some issues to be aware of before relying upon the break even sales concept. They are:

- Variable contribution margin. The contribution margin may not always be the same from month to month. If a company sells a different mix of products each month, and those products all have different margins, then the resulting blended margin for the entire business will probably change. This means that the break even sales level will also change.

- Historical basis. The fixed expenses figure in the numerator of the formula is based on historical fixed costs. For planning purposes, be sure to use an estimate of what fixed expenses are expected to be during the planning period, since these expenses may differ from the historical number.