Cash is known as most liquid and less productive assets of a firm. Cash management means optimal cash maintain in a business. If an excess is taken in a business, it is harmful because it does not grow profit. Contrary if the cash is taken deficit position them the liquidity crises exists. It is a key component of a company’s financial stability and solvency.

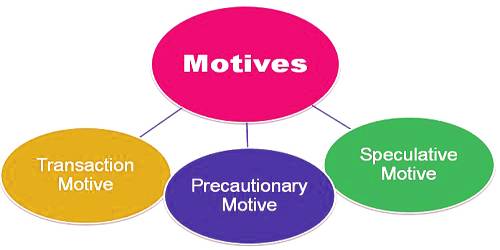

Motives for Holding: Cash There are some motives for holding cash. These are:

(a) Transaction Motive: An important reason for maintaining cash balances is the transaction motive. This refers to the holding of cash to meet routine Cash requirement to finance the transaction which a firm carries on in the ordinary course of business. Transaction means the act of giving and taking of cash or kinds in the ordinary course of business. Firms hold cash for making necessary payments for the goods and services they acquire.

(b) Precautionary Motive: Precautionary motive refers to hold cash as a safety margin to act as a financial reserve. In addition to the non-synchronization of anticipated cash inflows and outflows in the ordinary course of business, a firm may have to pay cash for purposes which cannot be predicted or anticipated. Firms hold cash to meet uncertainties, emergencies, running out of cash and fluctuations in cash balances.

(c) Speculative Motive: It refers to the need to hold cash in order to be able to take advantage of negotiating purchases that might happen, appealing interest rates and positive exchange rate fluctuations. The speculative motive helps to take advantages of the following:

- An opportunity to purchase raw materials a reduced price.

- Delay purchases of raw materials on the anticipation of a decline in price.

- To make a purchase at a favorable price.