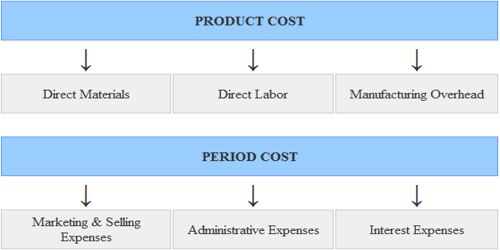

Product costs: For financial accounting purpose, products costs are that are involved in acquiring or making a product. In the case of manufactured goods, these costs consist of direct material, direct labor, and manufacturing overhead. These costs include direct labor, direct materials, consumable production supplies, and factory overhead. Product costs are viewed as ‘attaching’ to units of product as the goods are purchased or manufactured, and they remain attached as the goods go into inventory awaiting sale. It not an essential part of the manufacturing procedure. As a result, period costs cannot be assigned to the products or to the cost of inventory. So initially, product cost is assigned to an inventory as expenses (typically called cost of goods sold) and matched against sales revenue. Since production costs are initially assigned to inventories, they are also known as inventoriable costs.

The cost of a product on a unit basis is normally derived by compiling the costs related with a batch of units that were produced as a group and dividing by the number of units manufactured. The calculation is:

[(Total direct labor + Total direct materials + Consumable supplies + Total allocated overhead) ÷ Total number of units]

= Product unit cost