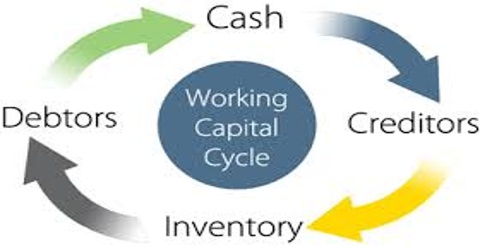

Working capital is the amount of a company’s current assets minus the amount of its current liabilities. The formula for working capital is: Current Assets – Current Liabilities. Apart from the investment in fixed assets every business organization needs to invest in current assets. This investment facilitates smooth day-today operations of the business. Current assets are usually more liquid but contribute less to the profits than fixed assets. Examples of current assets, in order of their liquidity, are as under.

- Cash in hand/Cash at Bank

- Marketable securities

- Bills receivable

- Debtors

- Finished goods inventory

- Work in progress

- Raw materials

- Prepaid expenses

These assets, as noted earlier, are expected to get converted into cash or cash equivalents within a period of one year. These provide liquidity to the business. An asset is more liquid if it can be converted into cash quicker and without reduction in value. Insufficient investment in current assets may make it more difficult for an organization to meet its payment obligations. However, these assets provide little or low return. Hence, a balance needs to be struck between liquidity and profitability.