Discounting of Bill of Exchange

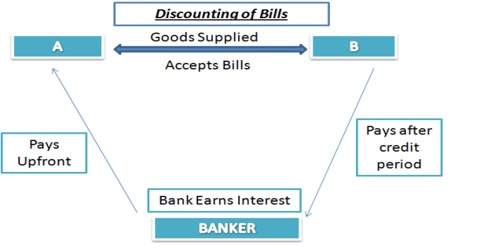

When the holder of a bill is in require of cash before the due date of a bill he can exchange it into cash by discounting the bill with his banker. This procedure is referred to as discounting of bill. The banker deducts a little amount of the bill which is called discount and pay the balance in cash instantly to the holder of the bill.

Explanation: If the holder of the bill is in require of cash before the due date of the bill, he can move toward the bank for encashment of the bill by discounting it. An accepted draft or bill of exchange sold for premature payment to a bank or credit institution at less than face value after the bank deducts fees and applicable interest charges. The bank or credit institution then collects full value on the draft or bill of exchange when payment comes due. The procedure of encasing the bill with the bank is called discounting of bill. The bank gets the amount from the drawee on the due date.

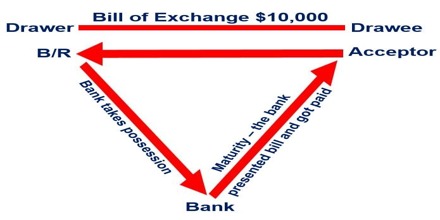

Example: For example, a drawer has a bill for $10,000. He discounted this bill with his bank two months before its due date at 15% p.a. rate of discount. Discount will be calculated as the follow: 1,000 × 15/100 × 2/12 = 250

Thus the drawer will receive cash worth $9,750 and will bear a loss of $250.

The bank will keep this bill in possession till the due date.