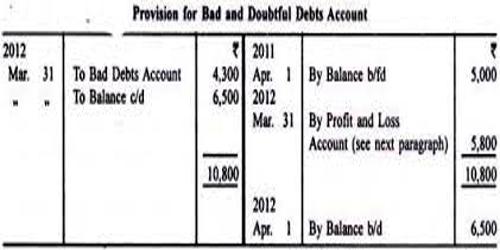

Provision for Bad and Doubtful Debts

Every business suffers a percentage of bad debts over and above the debts definitely known as irrecoverable and written off as Bad (Bad debts written off). The provision for doubtful debts is the estimated amount of bad debt that will arise from accounts receivable that have been issued but not yet collected. It is identical to the allowance for doubtful accounts. If Sundry debtors figure is to be shown correctly in the Balance sheet provision for bad and doubtful debts must be adjusted. This Provision for bad and doubtful debts is generally provided at a certain percentage on Debtors, based on past experience.

While preparing final accounts, the bad debts written off given in adjustment is first deducted from the Sundry debtors then on the balance amount (Sundry debtors – Bad debt written off) provision for bad and doubtful debts calculated.

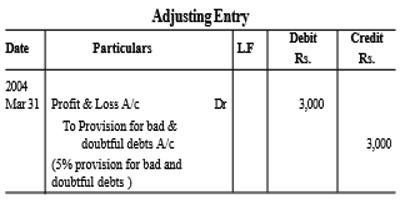

Example: The trial balance shows on 31.3.2004, Sundry Debtors as Rs.60,000.

Adjustment: Provide 5% provision for bad & doubtful debts on Sundry debtors.

Provision for bad and doubtful debts will be shown:

i) on the debit side of Profit and Loss Account and

ii) on the assets side of the Balance sheet by way of deduction from Sundry debtors (after Bad debts written off if any).

The allowance for doubtful debts reduces the receivable balance to the amount that the entity prudently estimates to recover in the future.