Boston Consulting Group Model

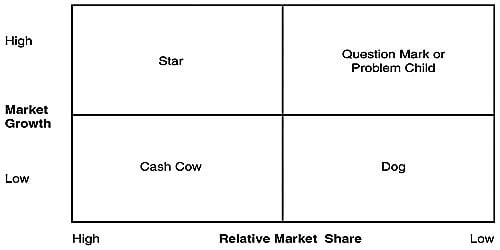

The Boston Counseling Group (BCG), a leading management consulting firm, developed and popularized the growth-share matrix. Using the Boston Counseling Group (BCG) approach, a company classifies all its SBUs according to the growth-share matrix shown below.

Fig: Relative market share

The vertical axis, market growth rate provides a measure of market attractiveness. On the horizontal axis, relative market share serves’ as a measure of company strength in the market. By dividing the growth-share matrix as indicated; four types of SBUs can be distinguished:

- Question marks

Businesses that operate in high-growth markets but have low relative market shares. As the name suggests, it’s not known if they will become a star or drop into the dog quadrant. These products often require significant investment to push them into the star quadrant. A question mark requires a lot of cash because the company has to spend money on plant, equipment, and personnel to keep up with the fast-growing market, and because it wants to overtake the market leader/Management has to think hard about which question marks it should try to build into stars and which should be phased out. Strategic choices: Market penetration, market development, product development, divestiture.

- Stars

Stars are high-growth, high share businesses or products. A star does not necessarily produce a positive cash flow for the company. Can be the market leader though require ongoing investment to sustain. They generate more ROI than other product categories. The company must spend substantial funds to keep up with the high market growth, and to fight off competitors’ attacks. However, because of their high growth rate, stars consume large amounts of cash. Eventually, their growth will slow down, and they will turn into cash cows. Star product can become Cash Cows as the market growth starts to decline if they keep their high market share. Strategic choices: Vertical integration, horizontal integration, market penetration, market development, product development.

- Cash cows

Cash cows are low-growth, high share businesses or products. These established and successful SBUs need less investment to hold their market share. The company uses its cash cows to pay bills and support other businesses. These are business units or products that have a high market share but low growth prospects. The company Procter & Gamble which manufactures Pampers nappies to Lynx deodorants has often been described as a ‘cash cow company’. Cash cows are still generating a significant level of income but are not costing the organization much to maintain. Strategic choices: Product development, diversification, divestiture, retrenchment.

- Dogs

Businesses that have weak market shares in low-growth markets. The usual marketing advice here is to aim to remove any dogs from your product portfolio as they are a drain on resources. They frequently break even, neither earning nor consuming a great deal of cash. These products are very likely making a loss or a very low profit at best. These products can be a big drain on management time and resources. They may generate enough cash to maintain themselves but do not promise to be large sources of cash. Strategic choices: Retrenchment, divestiture, liquidation.