The Bretton Woods system is the landmark for monetary and exchange rate management established in 1944. The Bretton Woods system was developed at the United Nations Monetary and Financial Conference held in Bretton Woods, New Hampshire, from July 1 to July 22, 1944.

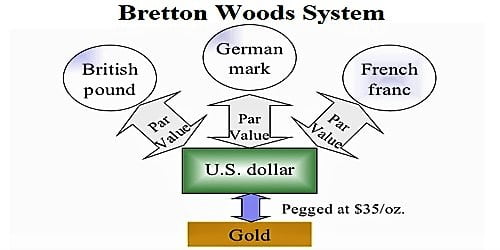

Major outcomes of the Bretton Woods conference included the formation of the International Monetary Fund and the International Bank for Reconstruction and Development and, most importantly, the proposed introduction of an adjustable pegged foreign exchange rate system. Currencies were pegged to gold and the IMF was given the authority to intervene when an imbalance of payments arose.

The Bretton Woods system of monetary management established the rules for commercial and financial relations among the world’s major industrial states in the mid-20th century. The Bretton Woods system was the first example of a fully negotiated monetary order intended to govern monetary relations among independent nation-states. The chief features of the Bretton Woods system were an obligation for each country to adopt a monetary policy that maintained the exchange rate by tying its currency to gold and the ability of the IMF to bridge temporary imbalances of payments. Also, there was a need to address the Jack of cooperation among other countries and to prevent competitive devaluation of the currencies as well.

Preparing to rebuild the international economic system while World War II was still raging, 730 delegates from all 44 Allied nations gathered at the Mount Washington Hotel in Bretton Woods, New Hampshire, United States, for the United Nations Monetary and Financial Conference, also known as the Bretton Woods Conference. The delegates deliberated during 1-22 July 1944 and signed the Bretton Woods agreement on its final day. The Bretton Woods system could not have worked without the IMF. Member countries needed it to bail them out if their currency values got too low. Setting up a system of rules, institutions, and procedures to regulate the international monetary system, these accords established the International Monetary Fund (IMF) and the International Bank for Reconstruction and Development (IBRD), which today is part of the World Bank Group. The United States, which controlled two-thirds of the world’s gold, insisted that the Bretton Woods system rest on both gold and the US dollar. Soviet representatives attended the conference but later declined to ratify the final agreements, charging that the institutions they had created were “branches of Wall Street.” These organizations became operational in 1945 after a sufficient number of had ratified the agreement.

On 15 August 1971, the United States unilaterally terminated convertibility of the US dollar to gold, effectively bringing the Bretton Woods system to an end and rendering the dollar a fiat currency. This action, referred to as the Nixon shock, created the situation in which the United States dollar became a reserve currency used by many states. At the same time, many fixed currencies (such as the pound sterling, for example), also became free-floating. The Bretton Woods system effectively came to an end in the early 1970s, when President Richard M. Nixon announced that the U.S. would no longer exchange gold for U.S. currency.

The breaking down of Bretton wood system –

One of the proposals of the Bretton Woods conference was that currencies should be convertible for trade and other current account transactions.

Following the end of World War II in 1945, Europe and the rest of the world embarked on a lengthy period of reconstruction and economic development to recover from the devastation inflicted by the war. Although gold initially served as the base reserve currency, the U.S dollar gained momentum as an international reserve currency that was linked to the price of gold. In 1973, Nixon unhooked the value of the dollar from gold overall. Without value controls, gold rapidly shot up to $120 per ounce in the free market. The Bretton Woods system was over.