Comparative advantage is an economic term that refers to an economy’s ability to produce goods and services at a lower cost than trade partners. The law of comparative advantage describes how, under free trade, an agent can produce more and use less of the good that has a comparative advantage for him. A country with comparative advantage makes trade successful. The advantages of buying a good or service outweigh the disadvantages. The theory of comparative advantage states that if countries specialize in producing products that cost them less, economic well-being will increase. In Ricardo’s theory, which was based on the theory of value labor (in fact labor was identified as the only cause of production), the fact that one country could produce everything more efficiently than another was not an argument against international trade.

Comparative advantage

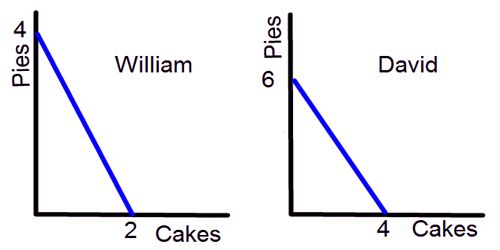

As an economic model, agents have a comparative advantage in producing a particularly good one compared to others if they can produce money at that comparatively low opportunity cost or at an archery price, i.e. at a low marginal cost before trading. Comparative advantage is a term associated with 19th century English economist David Ricardo. The law of comparative advantage is popularly attributed to the English political economist David Ricardo and his 1817 book “Political and Economics Basics,” although it was probably Ricardo’s adviser, James Mill, who initiated the analysis. Ricardo, considering what goods and services countries need to produce, suggested that they should specialize in the production of goods and services by allocating their scarce resources for which they have a comparative cost advantage. He showed that if two countries capable of producing were involved in the free market, each country would increase its overall consumption by exporting well for which it has a comparative advantage. There are differences in labor productivity between the two countries while importing other products. Simply put, an opportunity cost is a potential advantage that one can lose when choosing a particular option over another. In the case of comparative advantage, the opportunity cost for one company (i.e. the potential benefit that has been forfeited) is lower than the other.

The theory of comparative advantage provides a strong argument in favor of free trade and specialization between countries. A perfect advantage refers to the undisputed excellence of any country to produce better. The comparative advantage presents opportunity cost as an element of analysis to choose between different options for production cost. Widely regarded as one of the strongest but counter-intuitive insights of the economy, Ricardo’s theory implies that comparative advantage over absolute profit is responsible for most of the international trade. As the matter became significant, the simplification of the theory led to the assumption that the single component of production, a certain stock of assets, full employment, and the equilibrium exchange of goods were replaced by more realistic parameters.