Comparative Advantage of International Trade

The challenge to the absolute advantage theory was that some countries may be better at producing both goods and, therefore, have an advantage in many areas. In contrast, another country may not have any useful absolute advantages. To answer this challenge, David Ricardo, an English economist, introduced the theory of comparative advantage in 1817. Ricardo reasoned that even if Country A had the absolute advantage in the production of products, specialization and trade could still occur between two countries. In other words, the basis for emergence and growth of international trade can be completely dissimilarity in relative costs of manufacture of the commodities, in spite of the total amount of these costs.

Comparative advantage is a term associated with 19th Century English economist David Ricardo. It is a concept where Ricardo said comparative advantage stage is that a country should sell those products to other countries that it can produce most efficiently and effectively and buy those products from other countries that it cannot produce as effectively or efficiently.

Explanation

Comparative advantage occurs when a country cannot produce a product more efficiently than the other country; however, it can produce that product better and me efficiently than it does other goods. The difference between these two theories is subtle. Comparative advantage focuses on relative productivity differences, whereas absolute advantage looks at absolute productivity.

Comparative advantage suggests that countries will connect in do business with one another, exporting the commodities that they have a relative advantage in efficiency. This happens for the reason that though the lower-cost country suffers by importing some goods from the higher-cost country, it is more than remunerated by focused its resources on the production of those goods in which it has a better cost advantage.

The theory of comparative advantage explains why trade protectionism doesn’t work in the long run. Political leaders are constantly under force from their local constituents to defend jobs from international competition by raising tariffs. But that’s only a provisional fix. In the long run, it hurts the nation’s competitiveness. It allows the country to misuse resources on ineffective industries. It also forces customers to disburse higher prices to buy domestic goods.

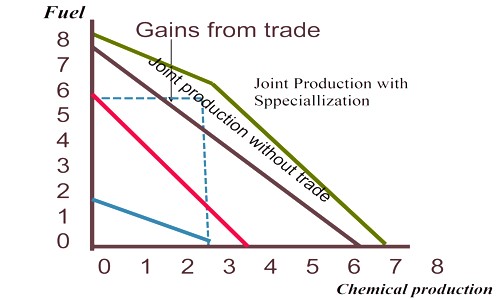

For example, Fuel-producing nations have a comparative advantage in chemicals. Their locally-produced Fuel provides an inexpensive resource of material for the chemicals when compared to countries without it. A lot of the raw ingredients are produced in the Fuel distillery procedure. As a result, Arabian Nations, UAE etc., are competitive with U.S. chemical production firms. Their chemicals are reasonably priced, making their opportunity cost low.

The Ricardian Model Assumption

To explain this theory Ricardo constructed a two-country, two-commodity, but one-factor model with the following assumptions:

- This theory assumes that trading countries have given industrious resources, which do not transform over time,

- Labour is the only industrious issue.

- Costs of production are considered in terms of the labor units concerned.

- This theory assumes that the economies of trading countries are completely viable.

- Labour is completely movable within a country but static globally.

- Trading costs are overlooked in this theory.

- Labour is homogeneous.

- There is unhampered or free trade.

- There are stable returns to scale.

- There is full employment stability.

- There is an ideal antagonism.

- It assumes that employment is the simple cost of production and the prices of goods in the market are resolute by their relative labor costs of production.

Under these assumptions, let us assume that there are two countries A and В and two goods X and Y to be produced.

Limitations

The limitation of the comparative advantage theory is in that assumption, on which it is based. It does not take into explanation the contact of overseas trade on returns allotment within a country, fluctuations in prices and wages, global capital movements.

- Transport costs may be more important than any comparative advantage

- Increased occupation may guide to diseconomies of scale

- Governments might confine trade

Another limitation of this theory is that it assumes the occurrence of stable returns. This is clearly very idealistic as changes in the financial formation of a country, its resources and other dimensions are essentially functioning.