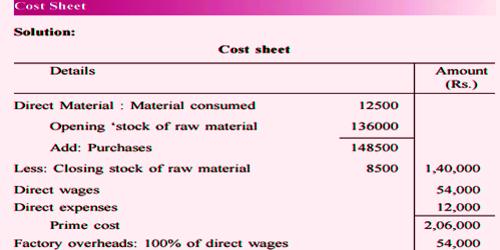

Cost Sheet is a document that reflects the cost of the items and services required by a particular project or department for the performance of its business purposes. It is prepared to know the outcome and breakup of costs for a particular accounting period. It is used to find out the cost of a cost object, i.e. product, service, or a cost unit.

Elements of cost sheet –

The Components of cost are shown in the classified and analytical forties the cost sheet.

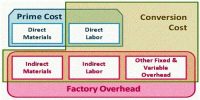

Components of total costs are as follows:

- Prime Cost = Direct materials + Direct Labor + Other Direct expenses

- Total Manufacturing Costs / Works Costs / Factory Costs = Prime Cost + Manufacturing Overhead.

- Cost of Goods Manufactured = Opening Work-in-Process (WIP) inventory + Manufacturing Costs / Works Costs / Factory Costs – Ending Work-in-Process (WIP) inventory.

- Cost of Goods Sold = Beginning Finished Goods inventory + Cost of Goods Manufactured – Ending Finished Goods inventory.

- Cost of Sales / Total Costs = Cost of Goods Sold + Operating Expenses / Commercial Expenses (i.e. Office & Administrative Expenses and Selling & Distribution Expenses).

If we add profit (or deduct loss) with the cost of sales, then we get sales;

Sales = Cost of Sales + Profit / (Loss).

Importance of Cost Sheet –

(1) It provides for the presentation of the total cost on the basis of the logical classification.

(2) Cost sheet helps in determination of cost per unit and total cost at different stages of production.

(3) Assists in fixing of selling price.

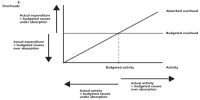

(4) It facilitates effective cost control and cost comparison.

(5) Enables the management in. the preparation of cost estimates to tenders and quotations.