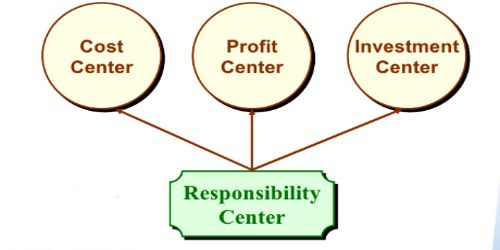

Measurement performance of cost center, profit center, and investment center

A cost center is a subunit of a company that is responsible only for as costs. Example of cost centers are the production departments and the service departments within a factory and administrative departments such as IT and accounting. It is a business unit that incurs expenses or costs but does not generate any revenue or money from selling goods and services for the company

A profit center is a subunit of a company that is responsible for revenues and costs. Often a division of a company is a profit center because it has control over its revenues, costs, and the resulting profits. It could be a subsidiary company, a department, a team, a production line, a project etc.

Cost centers and profit centers are usually associated with planning and control in a decentralized company. Like a cost center manager, a profit center manager does not have control over investment funds.

For example, a cost center is a unit that does not generate profit. A profit center has responsibility for generating profit, as all units have some level of costs. An investment center is usually found at higher levels in an organization where a unit manager has the responsibility of generating returns on investment capital. The manager of an investment center has control over cost, revenue, and investments in operating assets.