Risk and Return Tradeoff

The risk and return tradeoff could easily be called the “ability-to-sleep-at-night test.” It states that the potential return rises with an increase in risk. While some people can handle the equivalent of financial skydiving without batting an eye, others are terrified to climb the financial ladder without a secure harness. Deciding what amount of risk you can take while remaining comfortable with your investments is very important.

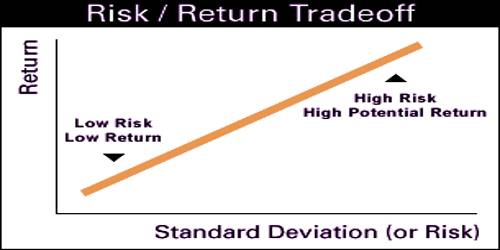

In the investing world, the dictionary definition of risk is the chance that an investment’s actual return will be different than expected. Technically, this is measured in statistics by a standard deviation. Risk means you have the possibility of losing some, or even all, of our original investment. This tradeoff which an investor faces between risk and return while considering investment decisions is called the risk-return trade-off.

Low levels of uncertainty (low risk) are associated with low potential returns; High levels of uncertainty (high risk) are associated with high potential returns. The risk/return tradeoff is the balance between the desire for the lowest possible risk and the highest possible return.

A common misconception is that higher risk equals greater return. The risk/return trade-off tells us that the higher risk gives us the possibility of higher returns. There are no guarantees. Just as risk means higher potential returns, it also means higher potential losses.

On the lower end of the scale, the risk-free rate of return is represented by the return on U.S. Government Securities because their chance of default is next to nothing. If the risk-free rate is currently 6%, this means, with virtually no risk, we can earn 6% per year on our money.

The common question arises: who wants to earn 6% when index funds average 12% per year over the long run? The answer to this is that even the entire market (represented by the index fund) carries risk. The return on index funds is not 12% every year, but rather -5% one year, 25% the next year, and so on. An investor still faces substantially greater risk and volatility to get an overall return that is higher than predictable government security. We call this additional return the risk premium, which in this case is 6% (12% – 6%).

Determining what risk level is most appropriate for you isn’t an easy question to answer. Risk tolerance differs from person to person. Your decision will depend on your goals, income, and personal situation, among other factors.