Steps to find the Errors in Trial Balance:

If the trial balance does not tally, it means there are various errors in the books of accounts. The different steps which might be taken to find the errors include the following:

Step 1: Check the overall of the trial balance and determine the accurate amount of dissimilarity in the trial balance. If there were an opening balance of amounts from the previous year, verify them.

Step 2: Verify that all the balances are correctly posted in the trial balance. The dissimilarity is halved to find out whether there is any balance of a similar amount in the trial balance. Find out the amount of dissimilarity by the two columns, divided by 2 and see similar amount appears in the Trial Balance. If a comparable figure exists, see whether it is in the correct column. It is because, such a balance might have been recorded on the wrong side of the trial balance and hence, the dissimilarity is double the amount.

Step 3: If the second step fails to find the error, the dissimilarity in the trial balance is divided by 9. If it is divisible by 9 without any remainder, the mistake is due to transposition of figures. For example, transposition of figures represents the writing of $ 780 for $ 870. Disarrangement of figures is transposition and trans-placement means the digits of the numbers are moved to the left or right. If the error remains undisclosed, verify all the postings in the ledger from Journal.

Step 4: See whether the balance of all ledger accounts including cash and bank balances are included in the trial balance. Recheck the amounts listed in the Trial balance and verify that all the ledger balances have been copied down.

Step 5: Ensure that all the opening balances have been appropriately brought forward in the current year’s books. Confirm that the opening balances have been properly brought forward in the current year, from the previous year. Re-examine the correctness of the posting from books of original entries to ledger accounts.

Step 6: If the dissimilarity in the trial balance is of big amount, the trial balance of the present year is compared with that of the earlier year and an account showing a big variation over the figure in the previous year’s trial balance should be rechecked. Re-compute the Account balances. Check the casting and carry forward of all subsidiary books. Re-check opening balances of all ledger accounts from the balance sheet of the previous year.

Step 7: If the error is not detected by the above steps, care should be taken to analyze the

- totals of all the subsidiary books

- posting made from the journal and the subsidiary books to the relevant ledger accounts

- balances extracted from the different ledger accounts

- totaling of the ledger balances

- verify the postings of individual items from the subsidiary books.

In this procedure examine any accumulation or removal of accounts. Also, examine those huge differences in the amount which are neither expected nor explained.

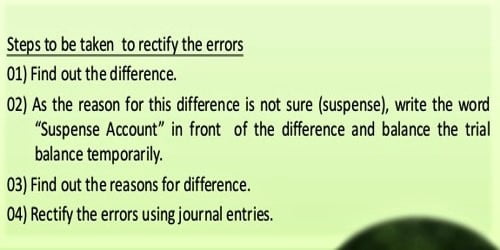

Even after following the above steps, if the error could not be located, the whole of the prime entry must once again be checked and in case of need, the posting to the ledger should be rechecked thoroughly. If the error is not detected take the difference between the debit column balance and credit column balance. Verify the totals of both columns of trial balance.